Debt portfolio structure

Russian Railways has made consistent efforts over the years to maintain the debt portfolio structure within the targeted parameters.

Russian Railways borrowed a total of RUB 200.6 bln in credit funds in 2014, including:

- RUB 50 bln from infrastructure bonds,

- RUB 24.8 bln from Eurobonds (at the exchange rate as of the placement date)

- RUB 125.8 bln from bilateral bank loans (including RUB 70.8 bln in short-term loans that mature in the same year).

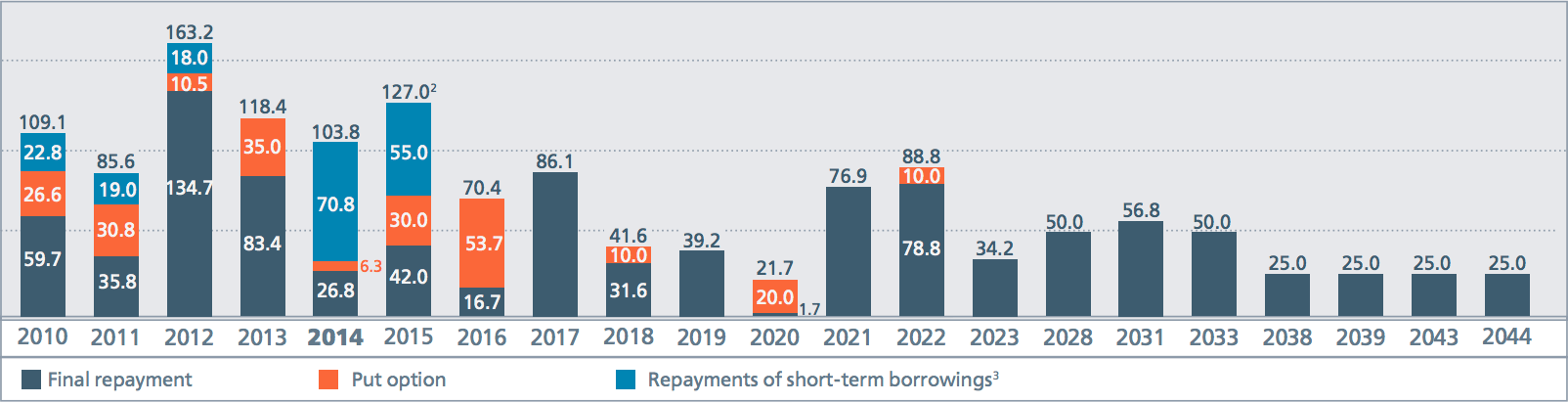

The Company also repaid RUB 103.8 bln during the reporting year, including short-term borrowings attracted during the year.

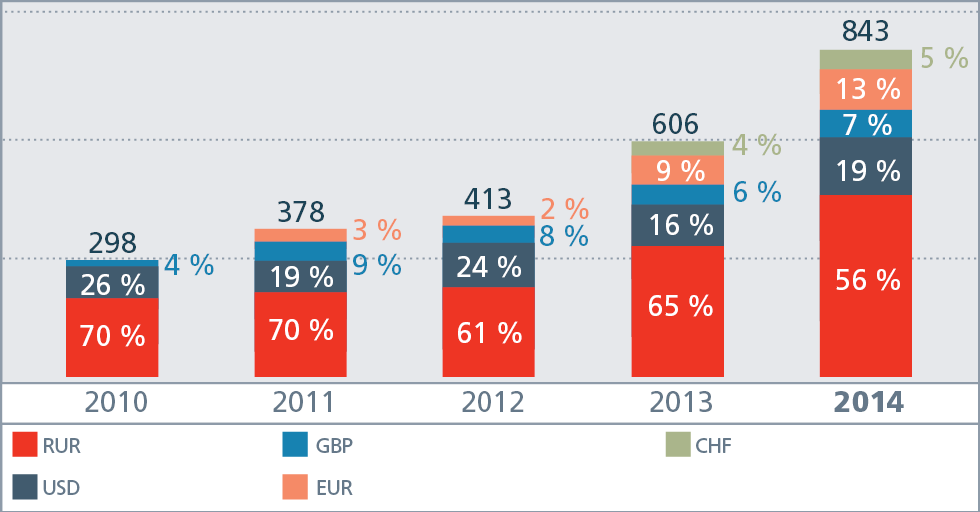

The overall debt (principal including exchange rate fluctuations, but excluding accrued interest) exceeded the 2013 by RUB 236.9 bln as of the end of 2014 and amounted to RUB 842.7 bln.

The long-term portion of the loan portfolio (maturity of more than 3 years) remained at 66% as of the end of 2014, while borrowings with maturity of less than one year made up 15% of the portfolio. A slight decrease (by 5%) in the proportion of long-term obligations in the loan portfolio compared with the end of 2013 is attributable to the receipt of RUB 55 bln in short-term credit funds in December 2014 for day-to-day liquidity management and settlements with suppliers in the first quarter of 2015.

The average maturity of liabilities was approximately 9 years as of the end of 2014. Debt repayment schedule ensures the even distribution of payments over the long term and minimises risks associated with refinancing. The largest single debt maturity denominated in foreign currency is planned for the early second quarter of 2017.

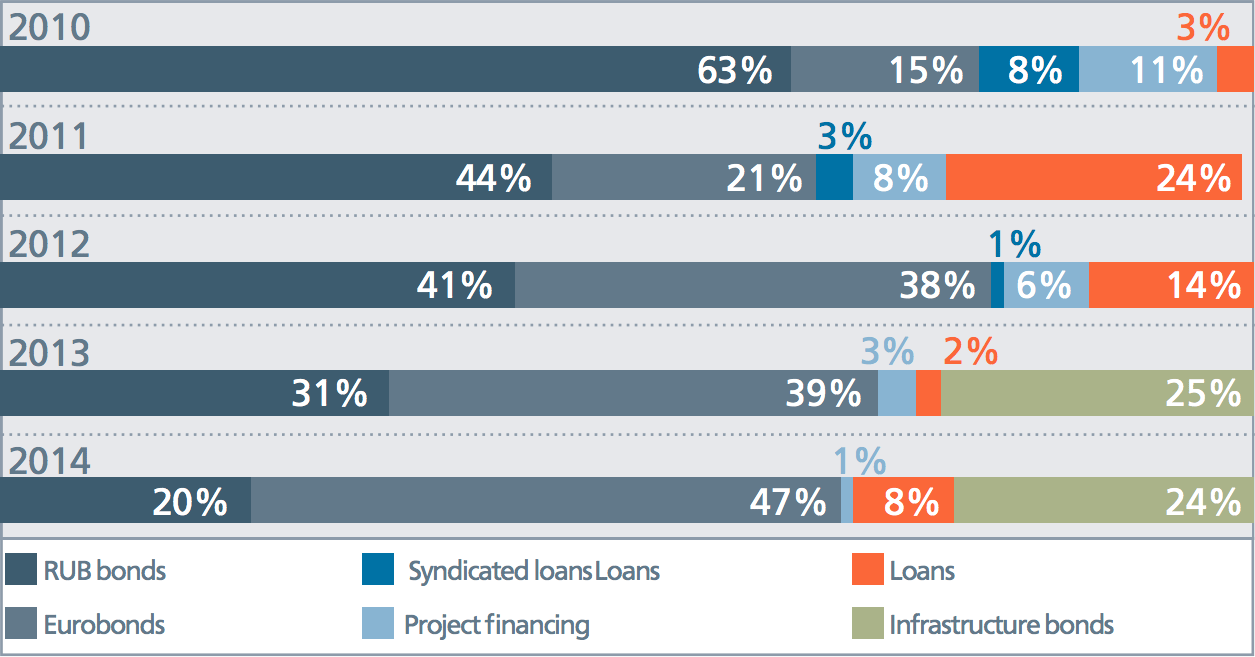

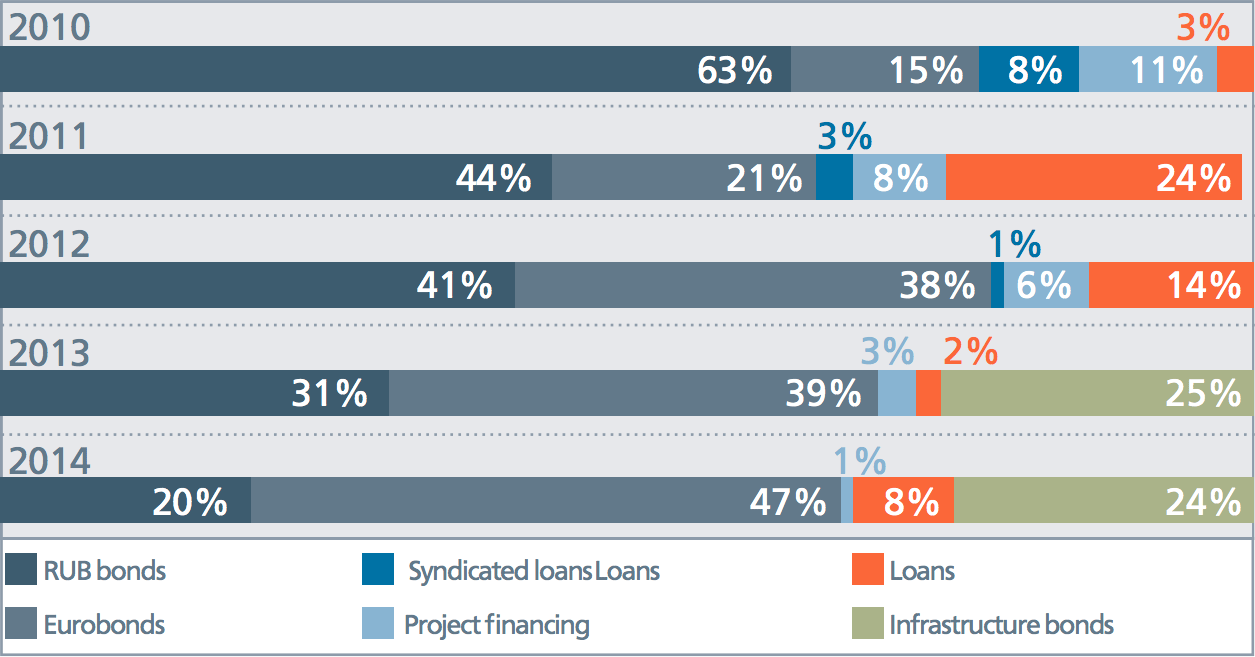

Russian Railways continued to maintain the diversified structure of its loan portfolio by instruments ans currencies. At the same time, taking into account the exchange rate revaluation, the proportion of Eurobonds primarily represented as borrowings denominated in foreign currency increased to 47% of the loan portfolio volume in the rouble equivalent, which can be attributed to the weakening of the rouble exchange rate in the fourth quarter of 2014.

The proportion of rouble-denominated borrowings in the Russian Railways loan portfolio decreased in 2014 due to the significant impact from the revaluation of borrowings denominated in foreign currency and stood at approximately 56% as of the end of 2014, which is 4% lower than the target set by the Company. However, this decrease is technical and a result of the weaker rouble. The long-term debt portfolio management policy remains unchanged in terms of maintaining the rouble-denominated portion of the portfolio at a level close to 60%.

Debt portfolio structure of Russian Railways by maturity as of 31 December 2014, RUB bln

Debt portfolio structure of Russian Railways by currency as of 31 December 2014, RUB bln

Debt portfolio structure of Russian Railways by instrument as of 31 December 2014

Debt repayment schedule of Russian Railways as of 31 December 2014 The planned repayments of the borrowings denominated in foreign currency are given according to the exchange rate as of 31 December 2014., RUB bln

* The planned repayments of the borrowings denominated in foreign currency are given according to the exchange rate as of 31 December 2014.

** Repayments in 2015 include RUB 55 bln in loan funds attracted in December 2014 for day-to-day liquidity management. At the same time, Russian Railways had funds of approximately RUB 86 bln on current and deposit accounts as of 31 December 2014.

*** Short-term borrowings drawn from revolving credit lines opened at Russian banks. Used for short-term liquidity management, generally for a period of up to 30 days.