Management of working capital

In accordance with its approved financial strategy, Russian Railways employs an aggressive model for the management of working capital, which involves reducing the financial cycle as much as possible in order to quickly release and spend funds on the financing of its current and investment activities.

Cash flow generated in the amount of RUB 18.9 bln

This model is marked by negative net working capital and means that the Company utilises its current liabilities as a source of investment activities.

In 2014, the Company’s negative net working capital totalled RUB (–125.4) bln. As a result of changes to the net working capital, a positive cash flow was generated in 2014 in the amount of RUB 18.9 bln.

Inventory management

The Company’s inventory was valued at RUB 69.0 bln as of 31 December 2014, down by RUB 14.1 bln from the start of the year.

Production process inventory declined versus 2013 by 3 days for materials and spare parts (from 54 days to 51 days) and by 1.5 days for fuel (from 27 days to 25.5 days).

Sales of 1.139 mln tonnes of scrap metal and the involvement of surplus materials and technical resources in economic turnover generated additional income of RUB 7.4 bln and savings of RUB 8.0 bln on the purchase of new material and technical resources.

| Item | Balance as of 31 Dec 2013 | Balance as of 31 Dec 2014 | Deviation +/- |

|---|---|---|---|

| Total inventories | 83.1 | 69.0 | –14.1 |

| including: | |||

| Raw materials and supplies, similar assets | 81.5 | 67.0 | –14.5 |

| Work in progress costs | 0.8 | 1.0 | +0.2 |

| Finished products and goods for resale | 0.2 | 0.4 | +0.2 |

| Shipped goods | 0.0 | 0.0 | 0.0 |

| Prepaid expenses | 0.6 | 0.6 | 0.0 |

Accounts receivable

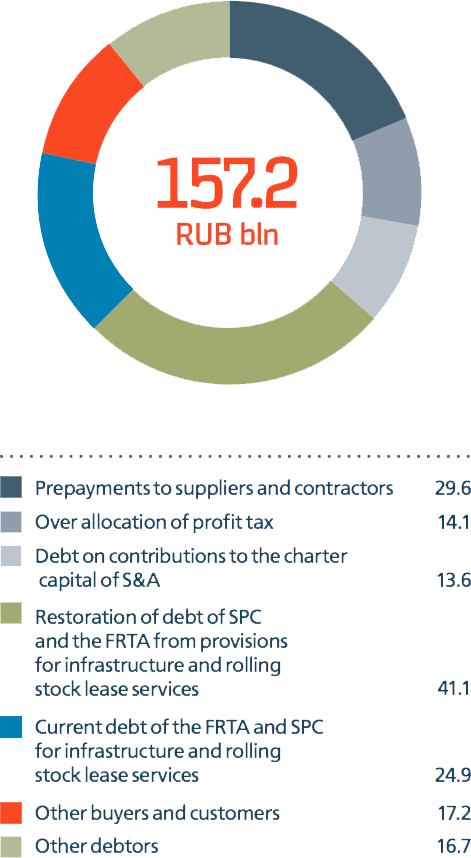

Total accounts receivable stood at RUB 157.2 bln at the end of the reporting year (an increase of almost 2 times, or RUB 78.0 bln, from the start of 2014).

| Item | Actual 31 Dec 2013 | Actual 31 Dec 2014 | Deviation +/- | Deviation, times |

|---|---|---|---|---|

| Total buyers and customers (accounts receivable for sales), including: | 23.3 | 82.7 | +59.4 | 3.5 times |

| for transportation | 2.3 | 34.8 | +32.5 | 15.1 times |

| other buyers and customers | 20.9 | 47.9 | +27.0 | 2.3 times |

| Prepayments | 10.3 | 8.7 | –1.6 | 84% |

| Social insurance and security | 0.3 | 0.4 | +0.1 | 1.3 times |

| Taxes and fees | 9.2 | 14.4 | +5.2 | 1.6 times |

| including profit tax | 6.8 | 14.1 | +7.3 | 2 times |

| Wage settlements with personnel and other transactions with accountable persons | 0.3 | 0.3 | 0.0 | — |

| Other debtors | 13.9 | 16.2 | +2.3 | 1.2 times |

| Total in current assets (according to balance sheet) | 57.3 | 122.7 | +65.4 | 2.1 times |

| Prepayments within non-current assets | 21.9 | 20.9 | –1.0 | 95% |

| Total prepayments | 32.2 | 29.6 | –2.6 | 92% |

| Debt on contributions to charter capital of S&A | — | 13.6 | — | — |

| TOTAL | 79.2 | 157.2 | +78.0 | 2.0 times |

| Indicator | 2013 | 2014 | +/— vs. 2013, days | +/— vs. 2013, % |

|---|---|---|---|---|

| Turnover period of accounts receivable for sales, days | 5.3 | 18.7 | +13.4 | 3.5 times |

| for shipments | 0.6 | 9.1 | +8.5 | 15.2 times |

| for other sales | 37 | 82.3 | +45.3 | 2.2 times |

The primary growth factors are:

- the restoration of accounts receivable from provisions for doubtful debts for infrastructure and rolling stock lease services provided to suburban passenger companies (RUB 41.1 bln);

- growth in current accounts receivable for infrastructure and rolling stock lease services provided to suburban passenger companies (RUB 13.5 bln);

- over allocation for taxes and fees (RUB +5.2 bln);

- contribution of property to the charter capital of Federal Passenger Company and Russian Railways Health through an additional share issue (RUB +13.6 bln). This debt arose due to the transfer of property through an additional share issue by Federal Passenger Company and Russian Railways Health prior to the registration of the shares.

As of the end of the reporting year, accounts receivable (including provisions for doubtful debts) from the provision of services to suburban passenger companies (including the debt of the Federal Railway Transport Agency) amounted to RUB 66.1 bln (RUB +13.5 bln compared to the start of the year), including:

- debt of the Federal Railway Transportation Agency totalled RUB 27.2 bln as of the end of the year;

- debt of suburban passenger companies totalled RUB 38.9 bln.

The turnover period of accounts receivable for sales (transportation and other sales) amounted to 18.7 days, an increase of 13.4 days compared with 2013 (the growth was part of the financial plan approved by the Russian Railways Board of Directors).

Accounts receivable of Russian Railways as of 31 December 2014, RUB bln

In order to repay the overdue debt of Suburban Passenger Company, the action plan approved by the Russian Government to prevent the projected losses of Russian Railways in

Accounts payable

Accounts payable increased by RUB 7.1 bln (2%) in 2014 to RUB 305.6 bln.

| Item | Actual on 31 December 2013 | Actual on 31 December 2014 | +/— vs. start of year | % vs. start of year |

|---|---|---|---|---|

| Debt to suppliers and contractors | 160.0 | 148.1 | –11.9 | 93% |

| for investment activities | 91.0 | 78.9 | –12.1 | 87% |

| for operating activities | 69.0 | 69.2 | 0.2 | 100% |

| Debt to personnel on wages and transactions with accountable persons | 14.7 | 13.6 | –1.1 | 93% |

| Debt for social insurance and security | 8.0 | 8.4 | 0.4 | 105% |

| Debt to budget for taxes and fees | 10.8 | 24.6 | 13.8 | 2.3 times |

| Prepayments received for other transactions | 20.1 | 22.3 | 2.2 | 111% |

| Prepayment of shipments | 71.7 | 78.1 | 6.4 | 109% |

| Other debt | 11.7 | 10.6 | –1.1 | 90% |

| TOTAL accounts payable | 297.1 | 305.6 | 8.5 | 103% |

| Plus long-term debt (Blagosostoyanie Private Pension Fund) | 1.4 | 0.0 | –1.4 | — |

| TOTAL | 298.5 | 305.6 | 7.1 | 102% |

| Indicator | 2013 | 2014 | +/— vs. 2013 | +/— vs. 2014, % |

|---|---|---|---|---|

| Turnover period | 36.8 | 34.5 | –2.3 | 94% |

| for operating activities | 31.6 | 29.2 | –2.4 | 92% |

| for investment activities | 43.0 | 42.1 | –0.9 | 98% |

Accounts payable to suppliers and contractors totalled RUB 148.1 bln as of the end of 2014, including RUB 78.9 bln for investment activities and RUB 69.2 bln for current activities.

The turnover period for accounts payable to suppliers and contractors totalled 34.5 days for the Company as a whole in 2014, which is consistent with the standard settlement conditions for contracts of Russian Railways.

Overdue accounts payable to suppliers and contractors makes up less than 1% of total debt.