Other income and expenses

In 2014, other income totalled RUB 252.5 bln and other expenses amounted to RUB 350.2 bln for a financial result of RUB (–97.7) bln.

| Item | Actual 2013 | Actual 2014 | Deviation of actual 2014 vs. actual 2013 | |

|---|---|---|---|---|

| +/— | % | |||

| Result from other income and expenses, including for the main items: | –39.4 | –97.7 | –58.3 | 248 |

| Sale of assets | 5.0 | 2.9 | –2.1 | 58 |

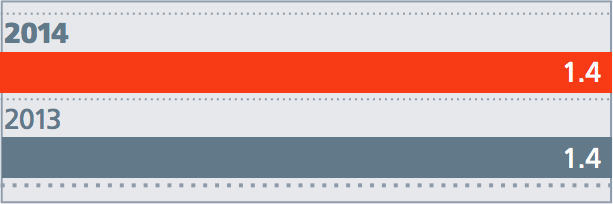

| Sale of shares | 1.4 | 1.4 | ||

| Dividends | 23.0 | 16.7 | –6.3 | 73 |

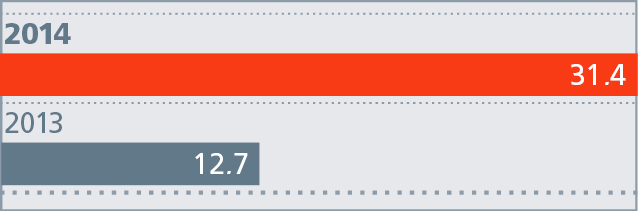

| Property contribution to charter capital | 12.7 | 31.4 | 18.7 | 247 |

| Interest receivable | 3.7 | 2.9 | –0.8 | 78 |

| Exchange rate differences | –18.4 | –142.5 | –124.1 | — |

| Change in provisions and other estimated liabilities | –1.7 | 38.7 | 40.4 | — |

| Budget funding | 0.9 | 27.6 | 26.7 | — |

| Interest payable excluding capitalised interest | –25.2 | –34.7 | –9.5 | 138 |

| Guarantees under the collective bargaining agreement for Company employees and their families as well as retirees | –27.8 | –26.8 | 1.0 | 96 |

1. Profit from the sale of stakes in subsidiaries

Income from the sale of shares totalled RUB 11.3 bln in 2014, while the Company’s profit from the sale of shares amounted to RUB 1.4 bln.

In 2014, the Company sold the following stakes:

- BeTelTrans — 50% minus two shares;

- First Non-Ore Company — 75% minus two shares;

- Vagonremmash — 75% minus two shares;

- Aeroexpress — 25%;

- Railway Transportation Technology, Control and Diagnostics Scientific Research Centre — 100% minus one share;

- Alatyr Mechanical Plant — 100% minus one share;

- Gryazi Railcar Repair Enterprise — 50% minus one share.

Income from the sale of stakes in subsidiaries increased by RUB 7.0 bln in 2014 compared with 2013 due to growth in the volume of the stakes sold in S&A (7 stakes in S&A in 2014 versus 3 stakes in 2013), while sales profit remained at the level of the previous year in 2014.

2. Income from contributing property to the charter capital of subsidiaries

- During the reporting year, the Company generated a positive financial result not underpinned by cash flow in the amount of RUB 31.4 bln from the following transactions:

- the establishment of UTLC through the contribution of 50% plus two shares in TransContainer and 100% minus one share in Russian Railways Logistics to the UTLC charter capital for a profit of RUB 23.1 bln;

- the contribution of property to the charter capital of Federal Passenger Company for a profit of RUB 6.1 bln;

- an additional share issue by Railcar Repair Company 1 and Russian Railways Health for a profit of RUB 1.3 bln;

- the conversion of shares in KIT Finance Investment Bank into shares of Absolut Bank for a profit of RUB 0.9 bln.

- a transaction to contribute freight cars to the charter capital of Federal Passenger Company generated RUB 12.7 bln.

3. Dividend income from Russian Railways subsidiaries

Dividend income from companies in which Russian Railways owns shares and stakes totalled RUB 16.7 bln in 2014 with the bulk of dividend payments (RUB 10.9 bln) coming from the additional capitalisation of Federal Freight Company and Federal Passenger Company through the receipt of a proportionate amount of dividends from these S&A from the retained earnings of previous years.

In 2013, dividends amounted to RUB 23 bln with Federal Freight Company accounting for the bulk of dividend income (RUB 16.9 bln).

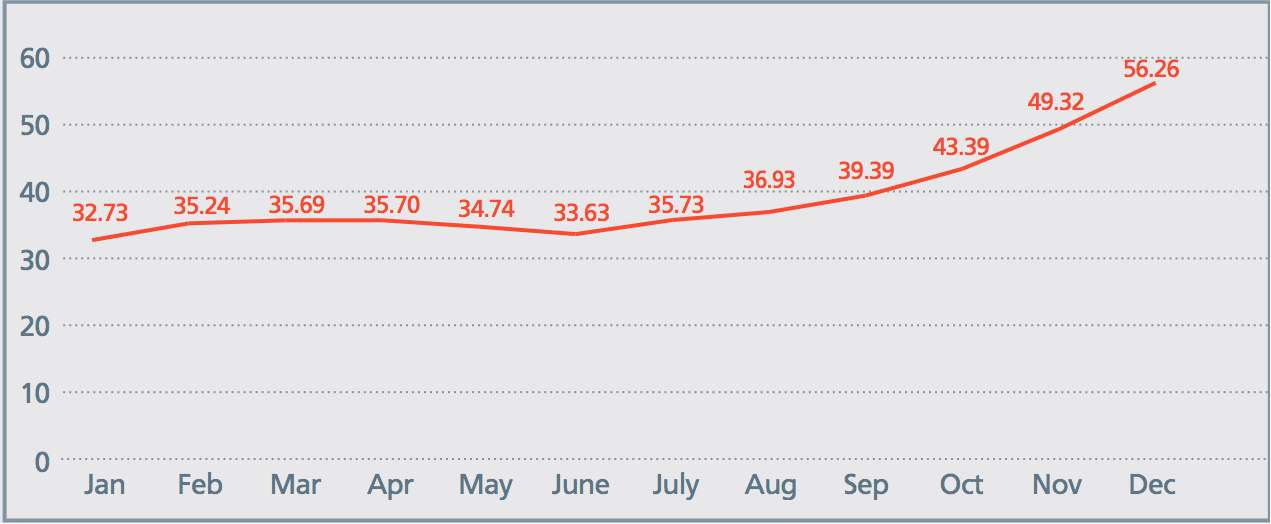

4. Exchange rate differences

The revaluation of the Company’s foreign currency liabilities in the reporting year resulted in a loss of RUB 142.5 bln from exchange rate differences.

The rouble shed 72.27% of its value versus the U.S. dollar in 2014, 52% versus the euro, 62% versus the pound sterling and 55% versus the Swiss franc.

Losses from exchange rate differences totalled RUB 18.4 bln in 2013

| Item | Actual 2013 | Actual 2014 |

|---|---|---|

| Decrease in RUB vs. USD over reporting period | –7.60% | –72.27% |

| RUB/USD exchange rate at end of period | 32.73 | 56.26 |

5. Debt servicing costs

Russian Railways had total interest payable of RUB 34.7 bln in 2014 excluding capitalised interest (total accrued interest for 2014 — RUB 45.7 bln).

In 2013, interest payable amounted to RUB 25.2 bln excluding capitalised interest (total accrued interest for 2013 — RUB 35.7 bln).

The growth in costs with respect to 2013 was due to changes in the proportion of capitalised interest and growth in the Company’s loan portfolio.

6. Social expenditures

The Company’s other expenses associated with guarantees under the collective bargaining agreement totalled RUB 29.6 bln in 2014.

At the same time, the Company managed to reduce expenditures 3.2% in 2014 compared with 2013 by effectively managing social costs and optimising the social protection system through the more efficient use of funds allocated for social purposes and the consistent implementation of the principles of targeted social aid.

The Company’s other expenses associated with guarantees under the collective bargaining agreement amounted to RUB 27.8 bln in 2013.

The Russian Railways collective bargaining agreement is concluded for a period of three years. The current collective bargaining agreement, which was adopted and registered by the Public Relations Committee of the Moscow Government as No.

7. Changes in provisions

The positive result from changes in provisions and other estimated liabilities totalled RUB 38.7 bln in the reporting year versus a negative financial result from changes in provisions and other estimated liabilities of RUB (–1.7) bln in the previous year.

Pursuant to the agreement with the Federal Railway Transportation Agency on the compensation of income losses resulting from the state regulation of tariffs for the infrastructure services of public railway transportation for suburban traffic in

In addition, the Company worked during the reporting year to sign schedules to restructure the debt of passenger companies for rolling stock lease services, which made it possible to restore previous provisions for doubtful debts in the amount of RUB 16.6 bln.