Long-haul passenger transportation

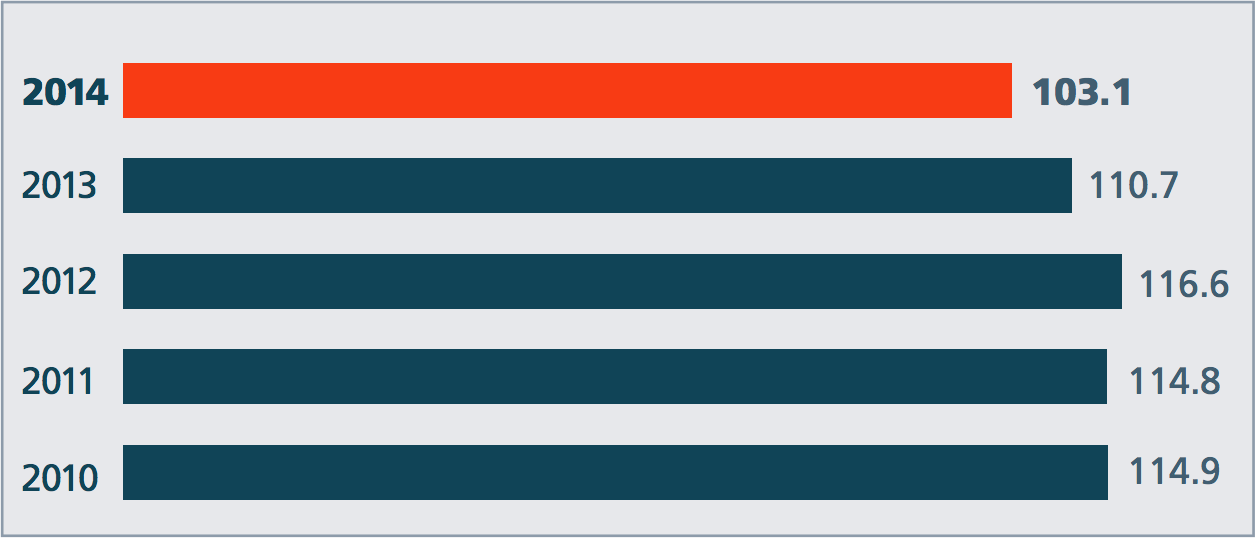

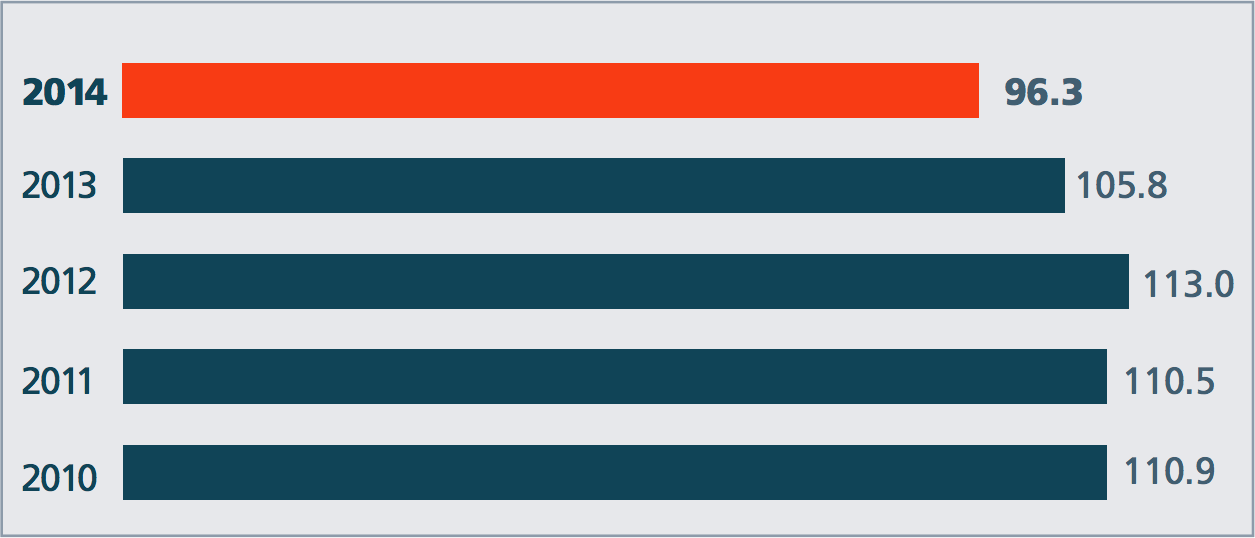

Long-haul passenger turnover via Russian Railways infrastructure declined 9% to 96.3 bln passenger km in 2014, while the number of passengers transported decreased 6.9% to 103.1 mln

Long-haul passenger turnover via Russian Railways infrastructure in 2014 totalled 96.3 bln pass. km A decrease of 9% compared with 2013

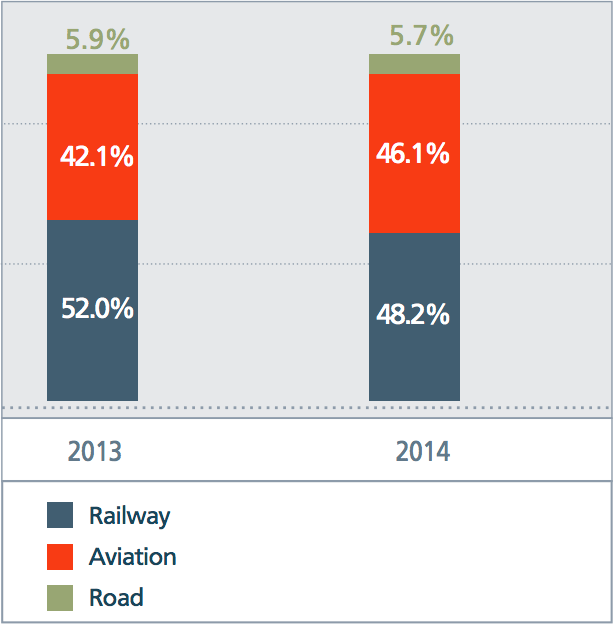

The following companies provide long-haul transportation services via Russian Railways infrastructure:

- S&A of Russian Railways (Federal Passenger Company, Sakhalin Passenger Company and Kuzbass Prigorod). Their share of passenger turnover is 97.0%;

- Independent carriers: Grand Service Express TC, Tverskoy Express and TransClassService. Their share of passenger turnover is 0.9%;

- High-Speed Transportation Directorate. Its share of passenger turnover is 2.1%.

The changes in passenger turnover resulted from a reduction in unprofitable trains and an increase in regulated transportation tariffs combined with a decrease in government subsidies.

A decline in indicators was seen across the board in long-haul transportation segments with the exception of high-speed traffic, which demonstrated growth of 3.9% in passenger turnover and 2.5% in passenger transportation.

Number of long-haul passenger trains via Russian Railways infrastructure, mln

Long-haul passenger turnover via Russian Railways infrastructure, bln pass. km

Federal Passenger Company transported 98.7 bln passengers in 2014, a 9.1% decrease from 2013, including 91.3 bln passengers via its own trains (down 7.3% compared with 2013):

- in the de-regulated segment — 28.5 bln passengers (down 10.4% compared with 2013);

- in the regulated segment — 62.8 bln passengers (down 5.8% compared with 2013).

The main reasons for the decline in passenger turnover and transportation by Federal Passenger Company in 2014 were:

-

In the regulated segment:

- with government support, air travel is expanding domestic traffic with subsidies for regional carriers as well as additional funding allocated for the development of aviation infrastructure and the aircraft fleet

-

In the de-regulated segment:

- in travel with CIS and Baltic countries — a sharp decrease in passengers to/from Ukraine given the geopolitical situation

- growth in tariffs for international traffic by 27% compared to the previous year’s level due to the pegging of transportation costs to the Swiss franc (the value of the franc increased 24%) and the rouble’s devaluation.

| Route | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|

| CIS, including | 96 | 102 | 96 | 55 |

| Ukraine | 95 | 101 | 100 | 38 |

| Baltic countries | 95 | 99 | 106 | 79 |

| non-CIS | 118 | 107 | 108 | 79 |

| TOTAL | 97 | 102 | 96 | 56 |

Given these factors and the decline they caused in operating performance, Federal Passenger Company’s income from core activities totalled RUB 185.6 bln in 2014 (or RUB 18.1 bln below the plan). Income from passenger transportation amounted to RUB 164.2 bln. For other sales, the target was RUB 21.5 bln and the shortfall amounted to RUB 0.1 bln, which is 0.7% below the approved budget level.

EBITDA, the primary indicator that reflects the effectiveness of the Company’s performance, totalled RUB 16.9 bln in 2014 (below the target of RUB 20.8 bln). The Company also posted a loss of RUB 0.4 bln in 2014 instead of planned net profit of RUB 0.7 bln.

In order to ensure the financial sustainability of the Company’s operations, an anti-crisis programme was prepared in 2014 along with projects in core operations with an effect of RUB 14.6 bln. The programme’s implementation cost for the year was RUB 15.3 bln, which is 4.3% above the established plan.